Africa: Eswatini (Swaziland) Report

NPF Electronic Return – New Submission File

The “Swaziland National Provident Fund (SNPF)” has officially changed to “Eswatini National Provident Fund (ENPF)”.

They have created a new electronic NPF 200 monthly return.

The ENPF will accept manual submissions until 31 June 2020. As from 1 July 2020 all employers must submit the new online (Excel) return on a monthly basis by emailing it (with the proof of payment) to [email protected].

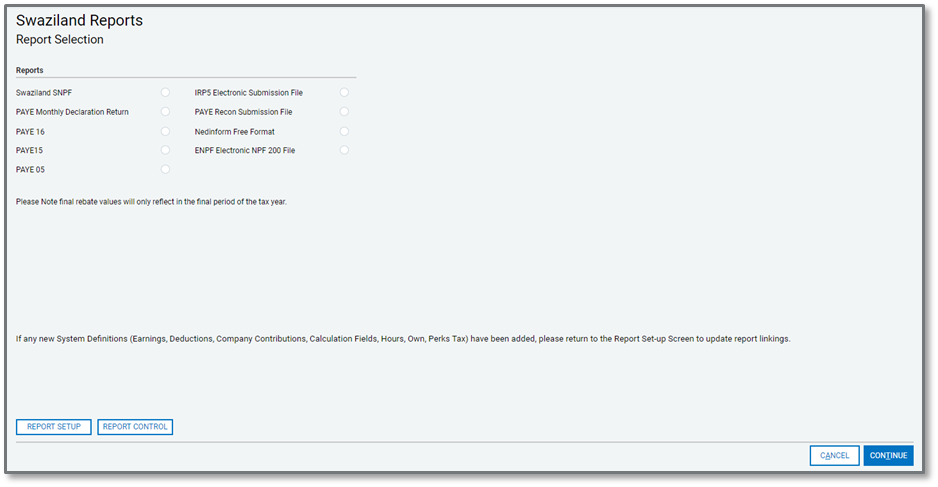

The new Eswatini NPF 200 Return report is available on the Swaziland Report Screen.

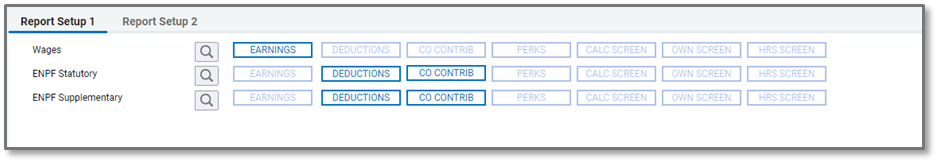

Before using the report, you must complete the Report Setup.

On the Report Setup, you must link the applicable Payroll Definition Lines to the selection fields for Wages, ENPF Statutory Contributions and ENPF Supplementary\Voluntary Contributions.

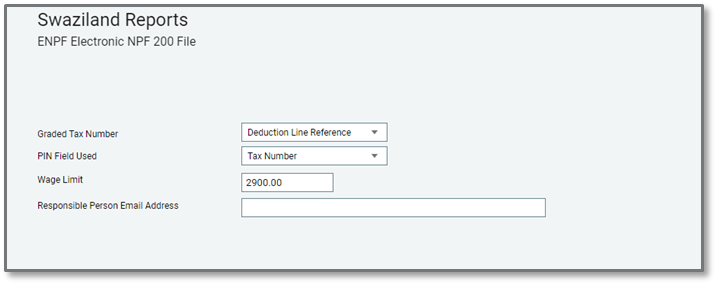

After completing all the Report Selections, you can select to run the report. When running the report, additional setup information is required and must be completed to create the submission file with the correct required values.

The following fields must be completed:

|

Field |

Description |

|

Graded Tax Number |

From the dropdown, select the field in the system where you capture employees’ Graded Tax Number. |

|

PIN Field Used |

From the dropdown, select the field in the system where you capture employees’ Tax PIN Number. |

|

Wage Limit |

The default for this field is the current maximum wage limit of 2 900.00 When the ENPF limit changes, you can update this field with the new limit to ensure the correct values populate the report.

|

|

Responsible Person Email Address |

Enter the email address of the officer responsible for submitting the return. |

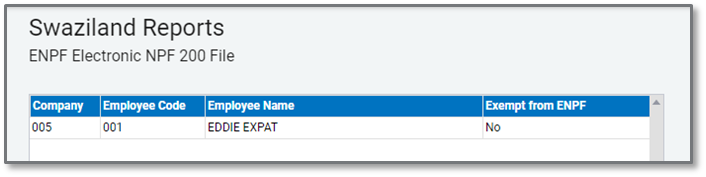

Once all the fields are completed, you can continue to print the report. Depending on the employees in your company, you might get to another screen that requires you to take additional actions before the report will create.

This screen will only be applicable if you have employees in your company that are still active that do not have income and\or ENPF contributions.

A requirement for this report is to include all active employees irrespective of whether they had income or an ENPF contribution. If an employee is specifically exempt from contributing to the ENPF scheme, only then should this person be excluded from the report. Because there is no indicator on the system to flag an employee as exempt from ENPF, you must indicate on this screen with a ‘Yes’ which employees are indeed exempt from ENPF so that they will be excluded from the report.

Once you have checked and confirmed all employees that are exempt or not, you can continue to run the report.

The report will open in Excel. You will be prompted to save the submission file in the selected location.